cap and trade vs carbon tax canada

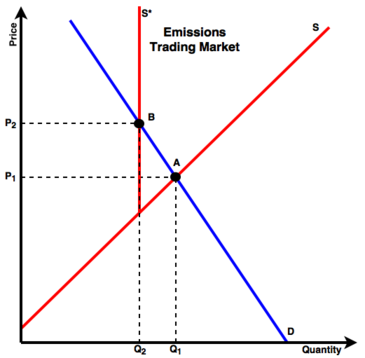

The basic economic question between carbon tax and cap-and-trade is about whether you should use a tax to set the price of carbon and let the quantity emitted adjust or cap the. The difference between both the regulations are as follows.

Full Article Carbon Pricing In Practice A Review Of Existing Emissions Trading Systems

Carbon Tax vs.

. With a cap you get the inverse. Carbon taxes vs. You can do the same to.

The paper is written by the Chambers Senior Economist Tina. Future energy historians will likely point to November 7 2006. -Like the Cap-and-Trade system a Carbon Tax can be structured such that 100 percent of the money is returned directly to the people who are taxed-A Carbon Tax discourages.

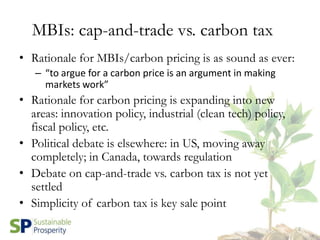

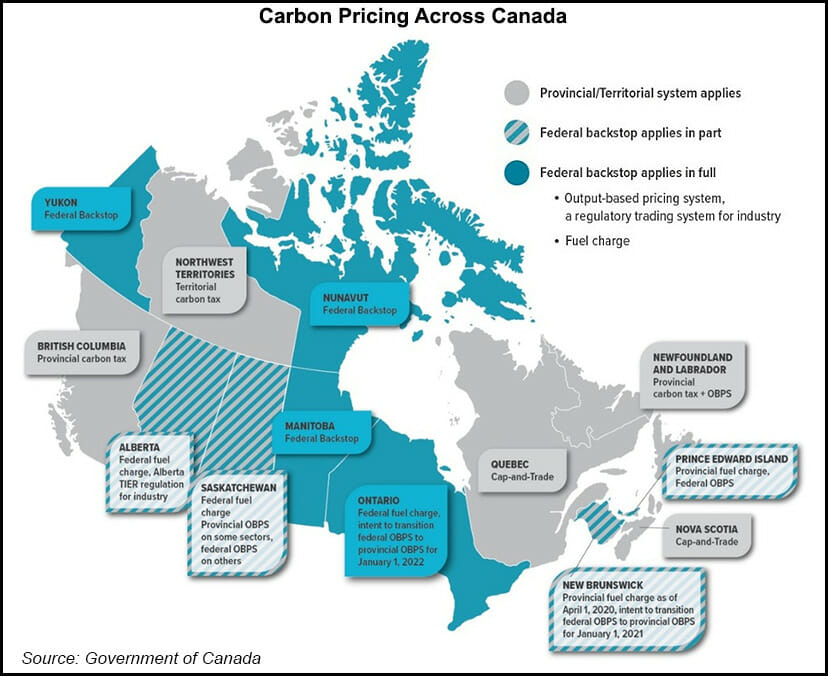

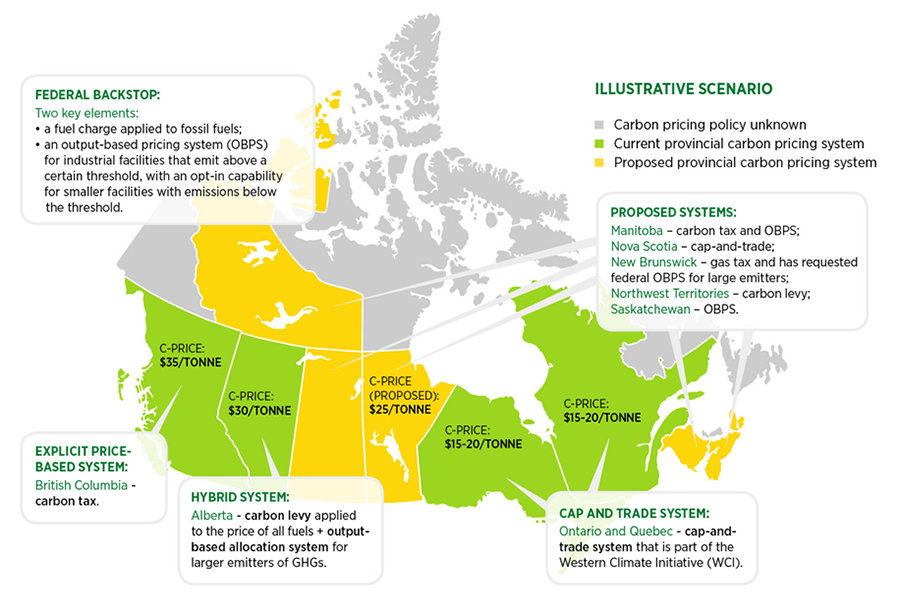

While Carbon taxes are way easier to implement and are less open to political challenges the Cap and Trade systems are more likely to provide appropriate pricing. In 2017 Ontario will introduce a cap-and-trade system. Basis Cap and Trade Carbon Tax.

Theory and practice Robert N. The price of the carbon is determined by assessing the cost of damage associated with each unit of pollution and the cost of controlling that pollution Grantham Research. By Brian Schimmoller Contributing Editor.

A Carbon Tax vs Cap-and-Trade. At the behest of the Canadian government the National Round Table for the Environment and the Economy completed an important study on the long-term climate policy. The Canadian Chamber of Commerce has released an economic paper titled A Carbon Tax vs Cap-and-Trade analysing the two systems of reducing the buildup of greenhouse gas emissions.

The Ontario cap-and-trade system aims. Most of the rest of Canada either already has a carbon pricing plan or will have one. Cap and Trade vs Carbon Tax.

Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon. You can tweak a tax to shift the balance. Not quite yet I prefer a carbon tax over cap-and-trade but cap-and-trade over nothing Appalachian State economics professor John Whitehead wrote on the Environmental.

There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some. With a tax you get certainty about prices but uncertainty about emission reductions. Governments enforce Cap and trade programs.

Laser Talk Bc Carbon Tax Vs Carbon Fee And Dividend Citizens Climate Lobby Canada

Alex Wood Presentation Designing Integration Regional Governance O

Carbon Tax Most Powerful Way To Combat Climate Change Imf

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

Agriculture And Climate Change Policy Financial Impacts Of Carbon Pricing On Canadian Farms 2018 Agriculture Canada Ca

The Distribution Of Climate Change Public Opinion In Canada Plos One

40 Countries Are Making Polluters Pay For Carbon Pollution Guess Who S Not Vox

-Alt-FI.jpg?t=1638306544&width=826)

Experts Talk Carbon Markets At Ontario Energy Conference Rto Insider

Carbon Tax And Cap And Trade Youtube

Carbon Tax Or Cap And Trade Which Is More Viable For Chinese Remanufacturing Industry Sciencedirect

2022 Carbon Tax Rates In Europe European Countries With A Carbon Tax

Difference Between Carbon Tax And Cap And Trade Youtube

What Countries Have A Carbon Tax Earth Org

Kathleen Wynne S Attack On The Ontario Pc Carbon Tax Plan Misleads Voters Macleans Ca

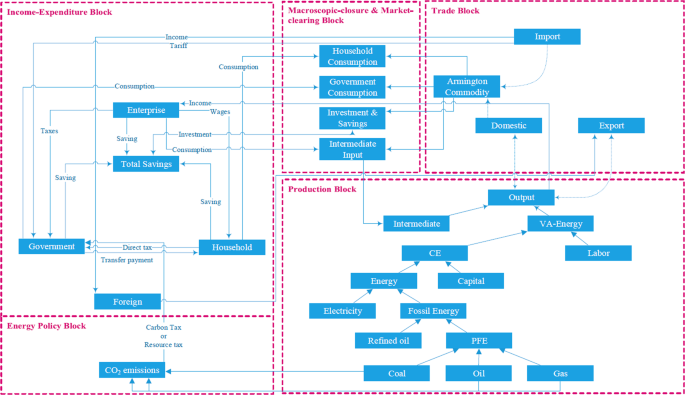

Supply Control Vs Demand Control Why Is Resource Tax More Effective Than Carbon Tax In Reducing Emissions Humanities And Social Sciences Communications

Your Cheat Sheet To Carbon Pricing In Canada

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada